Big changes are coming

At some point, people will consider exploring a quality Income Protection policy (or sick leave for life as I call it). The trigger is often a new job, the birth of a child, a home purchase or other significant event. It could just be an epiphany that automatic cover in our super just isn’t that trustworthy; it only costs a few dollars a month after all.

While it’s human nature to leave “look into Income Protection”’ on our to-do list for lengthy periods, it is genuinely a now or never task. Due to industry reform, retail policies purchased after 30th September 2021 will cover individuals for significantly less.

Here are the three biggest proposed changes:

1. Basic sum insured – Reduced to 60% per annum (less for high-income earners)

Paying a mortgage, raising a family & living the lifestyle you want forever is difficult enough, let alone a 40% lifetime pay cut.

Income Protection policies purchased after 30th September 2021 are likely to cap monthly benefits at 60% of pre-disability earnings for long-term claims (less for individuals who earn more than $240,000pa). Currently, the industry standard is 75%.

Example:

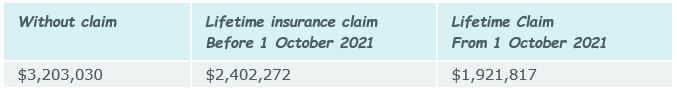

Total lifetime employment earnings over 25 years for an individual earning $100,000:

2. If you can do another job, the ability to claim may stop after 2 years.

Imagine if you could no longer work in your professional occupation due to an injury or illness. Still, you were medically cleared to work in a call centre or stack shelves in a supermarket.

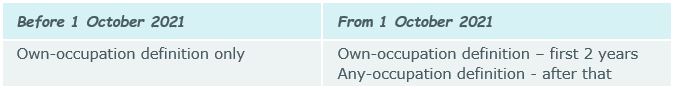

Income Protection policies purchased after 30 September 2021 are proposed to have an ‘any occupation’ definition after 2-years. This means that after two years, if a claimant can perform a different occupation based on age, training and experience, the ability to claim may stop. Currently, claims are assessed on the ability of an individual to perform their ‘own occupation’.

Example:

Claim ability of an individual who has worked as a high-earning site manager for 10 years.

The individual can no longer perform their ‘own’ role due to a permanent back issue, preventing them from standing on site for long periods. However, they can work in a call centre for significantly less pay.

3. Your other income will impact the amount you can claim

Many Australian’s build their assets to support their future or enhance their current lifestyle. Just because an individual gets income from your investment property doesn’t mean they don’t need their employment income as well, right?

It is proposed that Income Protection policies purchased after 30th September 2021 will consider some forms of passive income when assessing the amount that can be claimed. This is currently not the case.

Example:

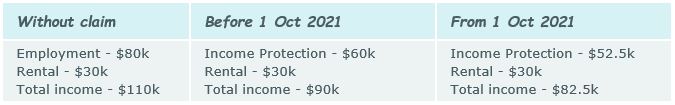

Total annual claim for an individual who earns $80,000 from employment and $30,000 pa from their rental property.

An additional kick in the teeth is that the individual’s Income Protection claim will likely reduce over time as the rental income increases.

Why are these changes taking place?

Retail life insurance companies have had catastrophic financial losses on their Income Protection products over the last few years. Unless change occurs, they are arguably on course to either go bust or increase premiums to unaffordable levels. Either event would create a disastrous underinsurance problem in Australia. As a result, the regulator has forced insurers to offer policies with lower levels of cover from 1 October 2021.

Any advice on this site is general nature only and has not been tailored to your personal objectives, financial situation and needs. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.