The ultimate playlist to avoid outliving your retirement savings

As the old Beatles song goes, “Money can’t buy you love,” but it can certainly help make your retirement years more comfortable and worry-free.

For many retirees, the biggest fear is outliving their retirement savings and being forced to sell their family home to cover living expenses. But fear not, because there are ways to avoid this scenario and keep on living comfortably in your own home well past your life expectancy.

Here are five things to consider, backed by some rocking tunes from my Retire Happy playlist for good measure:

“Money (That’s What I Want)” by Barrett Strong:

Consider purchasing a lifetime annuity

It’s like having a personal pension plan that pays you a guaranteed income for life, no matter how long you live. A lifetime annuity can provide peace of mind by ensuring a steady stream of income to cover your living expenses, allowing you to enjoy your retirement without worrying about running out of money.

The Centrelink assessable value for most income streams that commence after 1 July, 2019 is 60%, increasing the ability to access or increase an Age Pension entitlement.

“Don’t Stop Believin'” by Journey:

Keep Centrelink up-to-date with your financial information. As your assets or income decrease, you are usually eligible for additional government benefits, such as the Age Pension. So, it’s important to regularly update your financial information with Centrelink. Updating the value of your car, contents, bank accounts and super will ensure you’re receiving all the benefits you’re entitled to, helping you to retain more of your own savings.

“From Little Things Big Things Grow” by Paul Kelly:

Increase your exposure to growth assets. While it is important to have a diversified portfolio that includes defensive assets such as bonds and cash, increasing your exposure to growth assets such as shares and property can help your retirement savings keep pace with inflation and potentially generate higher returns over the long term. This is particularly important for younger retirees who still have many more adventures left in the tank.

“Money, Money, Money” by ABBA

Take advantage of government initiatives: There are a range of government initiatives designed to help retirees live comfortably during their golden years. For example, the Pension Loans Scheme allows retirees to access a loan from the government using their home equity as security. This can be a useful way to supplement your income and improve your quality of life.

“Don’t worry, be happy” by Bobby McFerrin

Find out if you have anything to worry about: Too many retirees worry and make the decision to spend less and work longer because they think they need to. But the fact is that most middle-class Australian retirees have had significant growth in their family home, a tax-free superannuation nest egg built over decades, and experience in keeping to a responsible budget through tougher times. So, get the facts by asking a professional to complete a financial analysis past your life expectancy. You may just find that you’re in a better position than you think.

In conclusion, there are many ways to ensure you can enjoy your retirement without worrying about outliving your savings or losing your home. By considering options like lifetime annuities, staying up to date with Centrelink, increasing your exposure to growth assets, taking advantage of government initiatives, and understanding how long your money will last, you can enjoy your retirement with peace of mind.

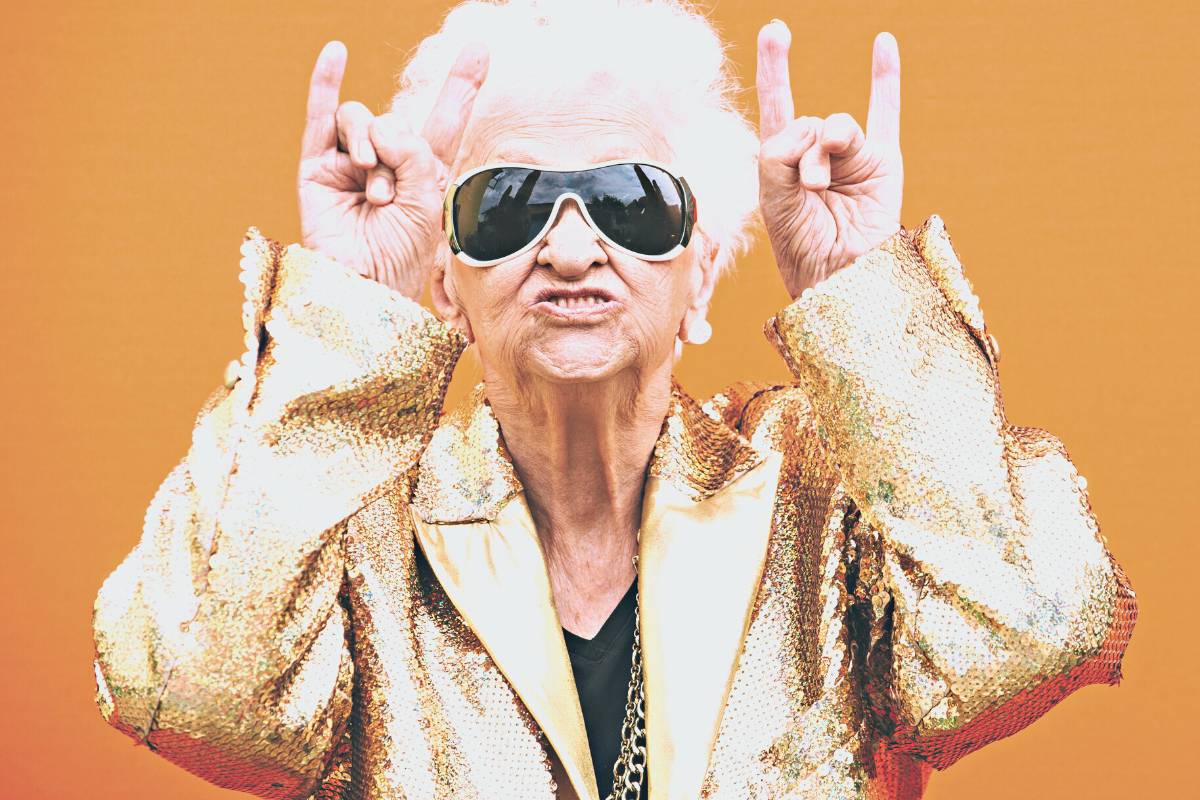

I hope you’re in the mood for one more, a David Bowie classic – “Golden Years”.

If this is something you’re interested in chatting about further, drop me a message at hello@finspective.com.au or book in a quick chat with me directly.

If you’re interested in learning how we can help you retire like a rock star, check out our Retirement Planning page for more information.

Any advice on this site is general nature only and has not been tailored to your personal objectives, financial situation and needs. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.